Proposed Residential Investment Property Changes

Scenario 1: Brightline 10/5 years

Buying or Selling a Residential property on or after the 27 March 2021.

Main home exclusion still applies if you are living in it.

If part of your main home was used for other purposes and that uses more than 50% of the property’s area the main home exclusion will not

apply and you will pay tax on profit when you sell it. For example, if you use 40% of a property as your main home and rent out 60% as a

granny flat, you cannot use the main home exclusion if you sell that property.

The bright-line test has been extended to 10 years. The bright-line property rule is if you sell a residential property you have owned for less than 10 years you may have to pay income tax.

If you build a new property, the bright-line test is still only 5 years.

Interest Rule changes:

Interest can no longer be claimed on loans used for residential properties as an expense against your income from those properties (starting 1 October 2021)

Additional borrowing on existing investment loan – still no interest is claimable

Outlined that there would be an exemption for the claim on interest component if the home was newly built.

Scenario 2: Brightline 5 years

If you have an existing Investment Property:

Acquired after 29 March 2018 and prior to 27 March 2021.

Main home exclusion still applies if you are living in it.

The bright-line test is 5 years if within the time period above.

Interest Rule changes:

Interest on any additional borrowing on residential investment loans are not claimable.

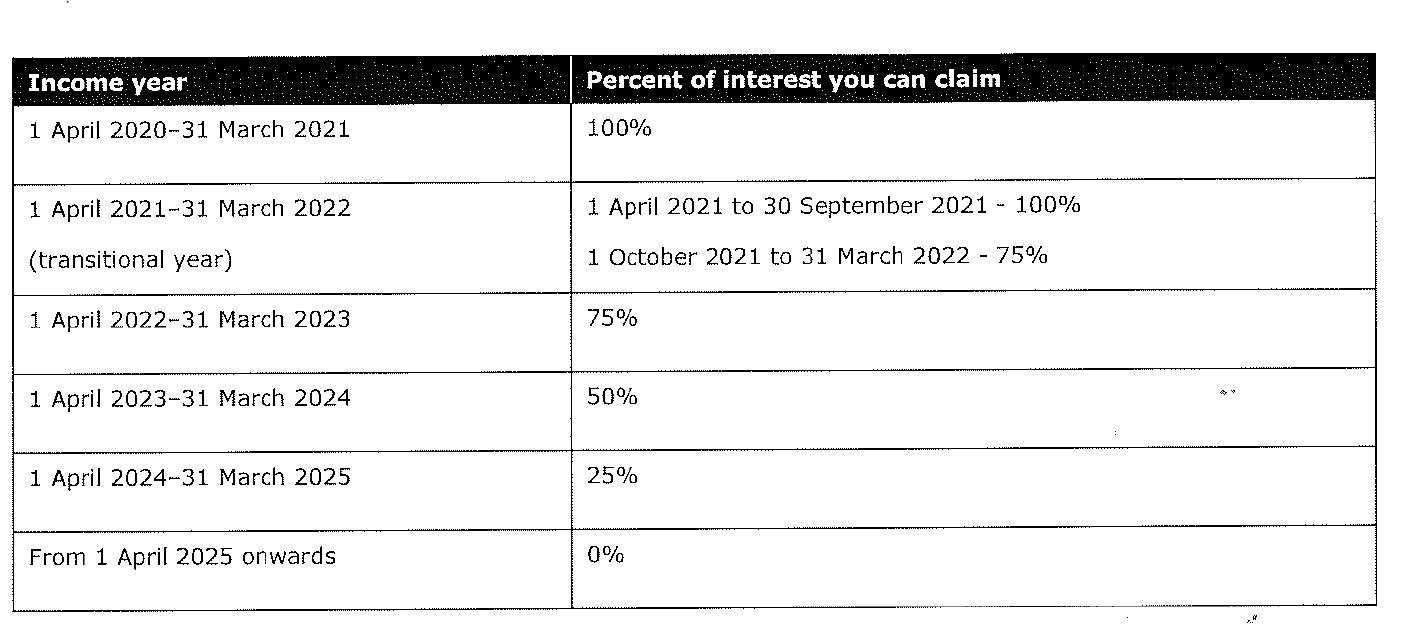

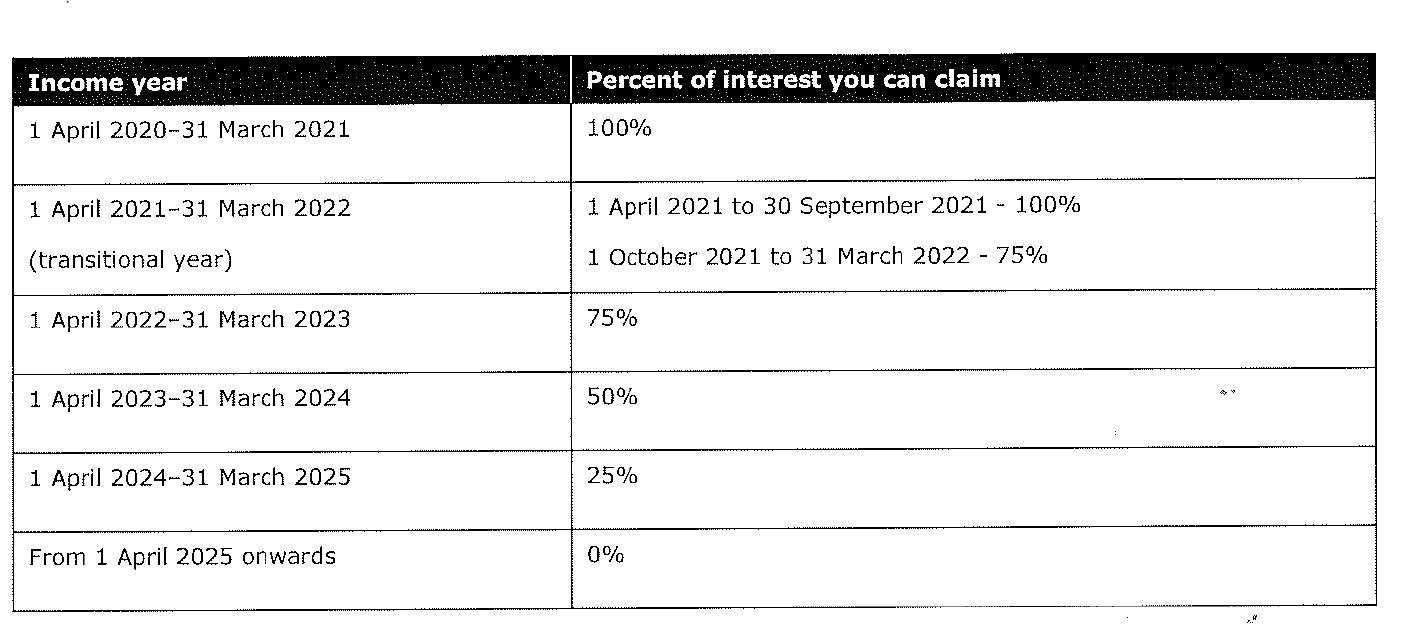

However, can still claim interest for loans that already existed for that property as an expense against the residential income. This will be reduced by 25% each income year until the ability for the deduction is completely phased out. Refer to the table below.

For properties bought after March 27 2021, the amount of deductible interest will drop for other properties until it is phased out in four years’ time.

New builds may be exempt, but Cabinet is yet to consult on this.

Scenario 3: Brightline 2 years

If you have an existing Investment Property:

Acquired after 1 October 2015 and prior to 28 March 2018.

Main home exclusion applies if you are living in it.

The bright-line test is 2 years if within the time above. (obviously now every house purchased within this time frame is out of the bright-line rule).

Interest Rule changes:

Interest on any additional borrowing on residential investment loans are not claimable.

However, can still claim interest for loans that already existed for that property as an expense against the residential income. This will be reduced by 25% each income year until the ability for the deduction is completely phased out. Refer to the table below.

If you have any general questions, feel free to use our contact us form on the website.